Machine Learning for Anomaly Detection: Uncover Financial Outliers

Machine learning for anomaly detection is crucial in finance for identifying outliers, predicting fraud, and ensuring data integrity by leveraging algorithms to spot unusual patterns.

In the world of finance, maintaining data integrity and identifying fraudulent activities are paramount. Machine learning for anomaly detection offers powerful tools to spot outliers and unusual patterns that might indicate financial crimes or data errors, enhancing security and compliance.

Understanding Anomaly Detection in Finance

Anomaly detection, also known as outlier detection, plays a vital role in the financial sector. It involves identifying data points that deviate significantly from the norm, often indicating fraudulent activities, errors, or critical events.

Traditional methods of anomaly detection can be time-consuming and may not be effective in handling the complexities of modern financial data. This is where machine learning comes into play, offering automated and sophisticated techniques to enhance detection accuracy and efficiency.

The Importance of Anomaly Detection

Anomaly detection is critical for preserving financial stability and preventing losses. It helps organizations proactively identify and address potential problems, ensuring compliance and maintaining investor confidence.

- Fraud Prevention: Identifying irregular transactions and preventing financial fraud.

- Risk Management: Spotting unusual patterns that may indicate increased financial risk.

- Data Quality: Identifying data errors and inconsistencies to maintain data integrity.

By leveraging machine learning, financial institutions can detect anomalies more effectively, leading to better decision-making and enhanced security.

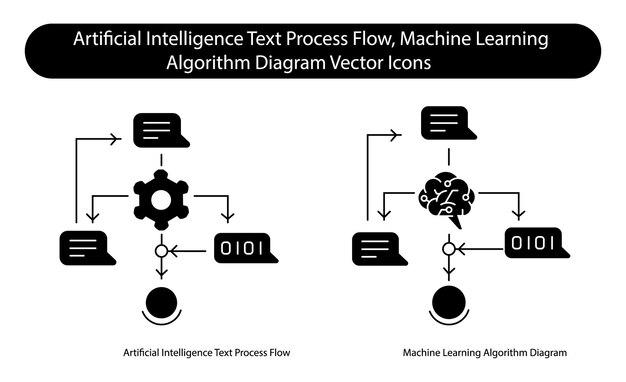

Machine Learning Techniques for Anomaly Detection

Several machine learning algorithms are well-suited for anomaly detection in financial data. These techniques can be broadly categorized into supervised, unsupervised, and semi-supervised methods, each with its own strengths and applications.

Understanding these various approaches allows financial professionals to choose the most appropriate method for their specific data and goals, enhancing their ability to detect irregularities efficiently.

Supervised Learning Methods

Supervised learning involves training a model on labeled data, where anomalies are pre-identified. This allows the model to learn patterns and classify new data points as either normal or anomalous.

The effectiveness of supervised learning depends heavily on the quality and representativeness of the labeled data, making it crucial to accurately label anomalies.

- Classification Algorithms: Using algorithms like Support Vector Machines (SVM) or decision trees to classify transactions.

- Regression Analysis: Predicting expected values and flagging deviations as anomalies.

- Performance Metrics: Employing metrics like precision, recall, and F1-score to evaluate model performance.

Unsupervised Learning Techniques

Unsupervised learning methods don’t require labeled data, making them suitable for datasets where anomalies are not pre-identified. These techniques identify anomalies based on inherent data patterns.

These methods are advantageous as they can discover previously unknown anomalies, providing more comprehensive insights into financial data.

Clustering Methods

Clustering algorithms group similar data points together, with anomalies appearing as outliers that do not fit into any cluster. These techniques are valuable when the normal behavior is well-defined.

One popular method is the k-means clustering algorithm, which partitions data into k clusters based on proximity to cluster centers. Anomalies are identified as data points far from these centers.

- K-Means Clustering: Grouping similar transactions and identifying outliers far from cluster centers.

- Density-Based Clustering: Identifying dense regions and marking sparse points as anomalies.

- Hierarchical Clustering: Building a hierarchy of clusters to identify anomalies at different levels.

Semi-Supervised Learning Approaches

Semi-supervised learning combines elements of both supervised and unsupervised learning. These methods are used when only a small amount of labeled data is available, along with a larger set of unlabeled data.

This approach can be more practical in real-world scenarios where labeled data is scarce and expensive to obtain. It involves training a model on the labeled data and then refining it using the unlabeled data.

One-Class SVM

One-Class Support Vector Machine (SVM) is a popular semi-supervised technique. It learns a boundary around the normal data points and flags any data points outside this boundary as anomalies.

This method is useful when the characteristics of anomalies are not well-defined, but the normal behavior is understood.

- Boundary Learning: Defining a boundary around normal data to identify anomalies.

- Kernel Functions: Using kernel functions to map data into higher dimensions for better separation.

- Parameter Tuning: Optimizing parameters to avoid overfitting or underfitting the data.

Practical Implementation of Anomaly Detection

Implementing machine learning for anomaly detection involves several key steps, from data preprocessing to model deployment and monitoring. Each step is critical to ensure the effectiveness and reliability of the detection system.

These implementations help financial institutions detect and prevent potentially harmful events in real-time.

Data Preprocessing

Data preprocessing is essential to ensure data quality and compatibility with machine learning algorithms. This involves cleaning, transforming, and scaling the data to improve model accuracy.

Common preprocessing techniques include handling missing values, removing outliers, and normalizing data to a standard range.

- Handling Missing Values: Impute missing data using mean, median, or other appropriate methods.

- Data Normalization: Scale data to a standard range to prevent bias in algorithms.

- Feature Engineering: Create new features that enhance the model’s ability to detect anomalies.

Challenges and Future Trends

Despite its advantages, implementing machine learning for anomaly detection faces several challenges. Addressing these challenges and staying abreast of future trends is crucial for continued advancement in this field.

As technology evolves, new techniques and approaches are emerging, offering even more sophisticated ways to detect anomalies.

Addressing Challenges

Key challenges include handling imbalanced datasets, dealing with evolving data patterns, and ensuring model interpretability. Addressing these issues requires a combination of advanced techniques and domain expertise.

One common challenge is the high false positive rate, which can lead to unnecessary investigations. Balancing precision and recall is essential for practical anomaly detection systems.

- Imbalanced Datasets: Use techniques like oversampling or undersampling to balance the data.

- Evolving Data Patterns: Implement adaptive models that can adjust to changing data characteristics.

- Model Interpretability: Choose models that provide insights into why certain data points are flagged as anomalies.

| Key Point | Brief Description |

|---|---|

| 🔍 Importance | Anomaly detection is critical for fraud prevention and risk management. |

| 🛠️ Techniques | Supervised, unsupervised, and semi-supervised methods are used. |

| 📊 Implementation | Data preprocessing and model monitoring are essential steps. |

| 🔮 Future | Advancements are focused on handling challenges and improving accuracy. |

FAQ

▼

Anomaly detection is the process of identifying data points that deviate significantly from the norm, indicating potential issues like fraud or errors.

▼

It helps in preventing financial fraud, managing risks, and ensuring data quality, all of which are crucial for stability and compliance.

▼

The main types include supervised, unsupervised, and semi-supervised learning, each suited for different datasets and objectives.

▼

Challenges include handling imbalanced datasets, evolving data patterns, and ensuring the model is interpretable for practical use.

▼

Data preprocessing ensures data quality by cleaning, transforming, and scaling data, enhancing the model’s accuracy and reliability.

Conclusion

In conclusion, machine learning for anomaly detection provides powerful tools to detect outliers and irregularities in financial data. By understanding the various techniques and addressing the challenges, financial institutions can enhance security, prevent fraud, and maintain data integrity, ultimately contributing to a more stable and trustworthy financial environment.