Detecting Fraudulent Transactions: A Machine Learning Approach for 99% Accuracy

Detecting fraudulent transactions with 99% accuracy through machine learning involves employing sophisticated algorithms to analyze patterns, identify anomalies, and predict potentially fraudulent activities, thereby mitigating financial risks and enhancing security measures.

In today’s digital age, the rise of online transactions has unfortunately brought with it an increased risk of fraud. Detecting fraudulent transactions with 99% accuracy: a machine learning approach is more crucial than ever for businesses and financial institutions seeking to protect their assets and customers.

The Growing Need for Advanced Fraud Detection

The landscape of fraud is continuously evolving, with fraudsters employing increasingly sophisticated methods to bypass traditional security measures. This necessitates the adoption of advanced technologies capable of identifying and preventing fraudulent activities in real-time.

The Limitations of Traditional Fraud Detection Systems

Traditional rule-based systems often struggle to keep pace with the dynamic nature of fraud. These systems rely on predefined rules and thresholds, which can be easily circumvented by fraudsters who constantly adapt their tactics.

Why Machine Learning is a Game-Changer

Machine learning offers a powerful alternative to traditional fraud detection methods. By learning from vast amounts of data, machine learning algorithms can identify subtle patterns and anomalies that would otherwise go unnoticed. This enables them to detect and prevent fraudulent transactions with greater accuracy and efficiency.

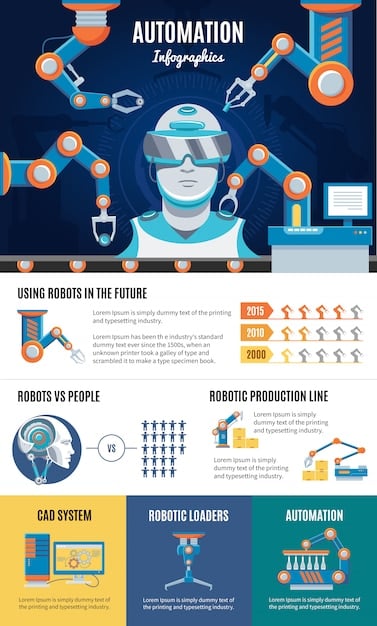

- Adaptability: Machine learning models can adapt to changing fraud patterns, ensuring continuous protection against emerging threats.

- Scalability: Machine learning systems can handle large volumes of data, making them suitable for businesses of all sizes.

- Automation: Machine learning automates the fraud detection process, reducing the need for manual intervention and freeing up resources.

In conclusion, the need for advanced fraud detection is critical in today’s digital environment. Machine learning offers a robust solution to overcome the limitations of traditional methods, providing adaptability, scalability, and automation to better protect businesses and consumers from fraud.

Key Machine Learning Algorithms for Fraud Detection

Several machine learning algorithms have proven effective in fraud detection. Each algorithm possesses unique strengths and is suited for different types of fraud scenarios. Understanding these algorithms is crucial for building a robust fraud detection system.

Logistic Regression

Logistic regression is a statistical model that predicts the probability of a binary outcome, such as whether a transaction is fraudulent or not. It’s a simple yet powerful algorithm that can be used as a baseline for fraud detection.

Decision Trees

Decision trees are tree-like structures that classify transactions based on a series of decisions. They are easy to interpret and can handle both numerical and categorical data.

Random Forests

Random forests are an ensemble learning method that combines multiple decision trees to improve accuracy and reduce overfitting. They are more robust than individual decision trees and can handle complex fraud patterns.

- Neural Networks: Neural networks are complex algorithms inspired by the structure of the human brain. They are capable of learning highly non-linear relationships in data and can achieve high accuracy in fraud detection.

- Support Vector Machines (SVM): SVMs are powerful algorithms that find the optimal hyperplane to separate fraudulent and non-fraudulent transactions. They are effective in high-dimensional spaces.

- K-Nearest Neighbors (KNN): KNN classifies transactions based on the majority class of its nearest neighbors. It’s a simple and intuitive algorithm that can be used for fraud detection.

In summary, logistic regression, decision trees, random forests, neural networks, SVMs, and KNN are key algorithms used in machine learning for fraud detection. The choice of algorithm depends on the specific requirements of the fraud detection system and the characteristics of the data.

Preparing Data for Machine Learning Fraud Detection

The success of any machine learning model depends heavily on the quality and preparation of the data. Data preprocessing is a critical step in the fraud detection process, ensuring that the data is clean, consistent, and suitable for training the model.

Data Collection

Gathering relevant data from various sources is the first step in data preparation. This may include transaction history, customer demographics, device information, and network data.

Data Cleaning

Cleaning the data involves handling missing values, correcting errors, and removing outliers. This ensures that the model is trained on accurate and representative data.

Feature Engineering

Feature engineering involves creating new features from existing ones to improve the model’s performance. This may include calculating transaction frequencies, identifying suspicious patterns, and creating indicators of fraudulent behavior.

Steps involved in data preparation:

- Data Transformation: Transforming the data involves scaling, normalizing, and encoding categorical variables. This ensures that the model is not biased towards certain features.

- Data Splitting: Splitting the data into training, validation, and testing sets is crucial for evaluating the model’s performance. The training set is used to train the model, the validation set is used to tune the model’s hyperparameters, and the testing set is used to evaluate the model’s final performance.

In conclusion, preparing data for machine learning fraud detection involves data collection, cleaning, feature engineering, data transformation, and data splitting. These steps are essential for ensuring that the model is trained on high-quality data and can accurately detect fraudulent transactions.

Evaluating the Performance of Fraud Detection Models

Evaluating the performance of fraud detection models is crucial to ensure that they are effective in identifying and preventing fraudulent transactions. Several metrics can be used to assess the performance of these models, providing insights into their accuracy, precision, and recall.

Accuracy, Precision, and Recall

Accuracy is the ratio of correctly classified transactions to the total number of transactions. Precision is the ratio of correctly identified fraudulent transactions to the total number of transactions predicted as fraudulent. Recall is the ratio of correctly identified fraudulent transactions to the total number of actual fraudulent transactions.

F1-Score

F1-score is the harmonic mean of precision and recall. It provides a balanced measure of the model’s performance, taking into account both false positives and false negatives.

AUC-ROC Curve

The Area Under the Receiver Operating Characteristic (AUC-ROC) curve is a graphical representation of the model’s performance across different classification thresholds. It provides a comprehensive measure of the model’s ability to distinguish between fraudulent and non-fraudulent transactions.

Other important considerations:

- Confusion Matrix: A confusion matrix provides a detailed breakdown of the model’s predictions, showing the number of true positives, true negatives, false positives, and false negatives.

- Cost-Sensitive Evaluation: Cost-sensitive evaluation takes into account the costs associated with false positives and false negatives. This is particularly important in fraud detection, where the cost of missing a fraudulent transaction can be high.

In summary, evaluating the performance of fraud detection models involves using metrics such as accuracy, precision, recall, F1-score, and AUC-ROC curve. These metrics provide insights into the model’s ability to accurately identify and prevent fraudulent transactions, ensuring that the system is effective and reliable.

Real-time Fraud Detection Systems

Real-time fraud detection systems are designed to identify and prevent fraudulent transactions as they occur. These systems leverage machine learning algorithms to analyze transactional data in real-time, providing immediate alerts and preventing financial losses.

The Architecture of a Real-time System

A real-time fraud detection system typically consists of several components, including a data ingestion pipeline, a feature engineering module, a machine learning model, and an alert management system.

Data Ingestion and Preprocessing

The data ingestion pipeline collects transactional data from various sources and preprocesses it for analysis. This may involve cleaning the data, transforming it into a suitable format, and storing it in a real-time data store.

Feature Engineering and Model Prediction

The feature engineering module extracts relevant features from the preprocessed data and feeds them into the machine learning model. The model then predicts the probability of the transaction being fraudulent.

- Alert Generation and Management: If the predicted probability exceeds a certain threshold, an alert is generated and sent to the alert management system. The alert management system then triages the alerts and takes appropriate action, such as blocking the transaction or notifying the fraud investigation team.

- Technology Stack: Real-time fraud detection systems often utilize a combination of technologies, including stream processing frameworks (e.g., Apache Kafka, Apache Flink), machine learning platforms (e.g., TensorFlow, PyTorch), and real-time databases (e.g., Cassandra, Redis).

In conclusion, real-time fraud detection systems are essential for preventing financial losses and protecting businesses from fraudulent activities. These systems leverage machine learning algorithms and real-time data processing techniques to analyze transactions as they occur, providing immediate alerts and enabling proactive fraud prevention.

Challenges and Future Trends in Fraud Detection

While machine learning has made significant strides in fraud detection, several challenges remain. Addressing these challenges and staying abreast of future trends is crucial for maintaining effective fraud detection systems.

Data Imbalance

Fraudulent transactions typically represent a small fraction of the total number of transactions, leading to imbalanced datasets. This can bias machine learning models towards the majority class, resulting in poor performance in detecting fraudulent transactions.

Concept Drift

Fraud patterns can change over time, leading to concept drift. This requires continuous monitoring and retraining of machine learning models to ensure that they remain effective.

Explainability and Interpretability

Some machine learning models, such as neural networks, are complex and difficult to interpret. This can make it challenging to understand why a particular transaction was flagged as fraudulent, hindering the ability to investigate and prevent fraud effectively.

Emerging trends in the field:

- Explainable AI (XAI): XAI techniques aim to make machine learning models more transparent and interpretable, allowing fraud investigators to understand the reasoning behind the model’s predictions.

- Federated Learning: Federated learning enables machine learning models to be trained on decentralized data sources without sharing the data itself. This can improve privacy and security while still leveraging the benefits of machine learning.

- Graph Neural Networks (GNN): GNNs are a type of neural network that can analyze graph-structured data, such as social networks and transaction networks. They are particularly effective in detecting complex fraud schemes involving multiple actors and transactions.

In summary, challenges such as data imbalance, concept drift, and explainability remain in fraud detection. However, emerging trends such as XAI, federated learning, and GNNs are paving the way for more effective and robust fraud detection systems that can adapt to the evolving landscape of fraud.

| Key Point | Brief Description |

|---|---|

| 🛡️ Advanced Fraud Detection | Using ML for real-time, adaptable fraud prevention. |

| 📊 Key ML Algorithms | Logistic Regression, Decision Trees, Neural Networks, etc. |

| Data Preparation | Cleaning, transforming, and engineering features for better model accuracy. |

| Real-time Systems | Analyzing transactions instantly for fraud prevention. |

Frequently Asked Questions (FAQ)

▼

Machine learning fraud detection uses algorithms to analyze transaction data, detect patterns, and flag potentially fraudulent activities in real-time. It’s an automated and adaptive approach to fraud prevention.

▼

Accuracy varies, but advanced models can achieve up to 99% accuracy. The actual rate depends on data quality, feature engineering, and model selection. Continuous monitoring and retraining are essential.

▼

Machine learning can detect various types of fraud, including credit card fraud, insurance fraud, healthcare fraud, and identity theft. It adapts to new patterns and emerging fraud techniques.

▼

Benefits include real-time detection, adaptability to new fraud patterns, high accuracy, and automated processes. It also reduces the need for manual intervention and improves overall fraud prevention.

▼

Challenges include imbalanced datasets, concept drift, and model interpretability. Addressing these requires continuous monitoring, retraining, and explainable AI techniques to enhance detection.

Conclusion

In conclusion, detecting fraudulent transactions with 99% accuracy: a machine learning approach represents a significant advancement in fraud prevention. By leveraging advanced algorithms, preparing data effectively, and continuously evaluating performance, businesses can protect themselves and their customers from the ever-evolving threat of fraud, securing a safer digital future.